Entering 2023, the consensus outlook was bearish for most asset classes. Inflation would remain stubbornly high. Interest rates would continue to rise and remain higher for much longer. Corporate earnings […]

Mid-Year Asset Class Stoplight

How has Osborne Partners’ asset-class positioning changed since the October 2022 lows? Markets surprised the consensus view in the first half of 2023. Entering the year, the common view for […]

First Republic Bank – “It WAS a Privilege to Serve You”

An analysis of the bank’s collapse, the implications for its clients, the ongoing risks to other banks, and the broader market and economic implications. Early on the morning of May […]

Known Unknowns

There are known knowns; there are things we know we know. We also know there are known unknowns… “There are known knowns; there are things we know we know. We […]

The Fog of War

Perspective amid a volatile year as the Fed battles inflation. Fog often envelopes the Bay Area. At times, it is very dense, limiting visibility and raising uncertainty for travelers. […]

2022’s Painful Lessons

In this piece, we review the important lessons that investors learned so far in 2022, and why our Investment Team strives to avoid these mistakes every day. As the painful […]

Stagflation Redux?

Are we poised to relive the economic malaise of the 1970s and early-1980s? Inflation emerged as the primary concern for the markets during the second quarter. The Consumer Price Index […]

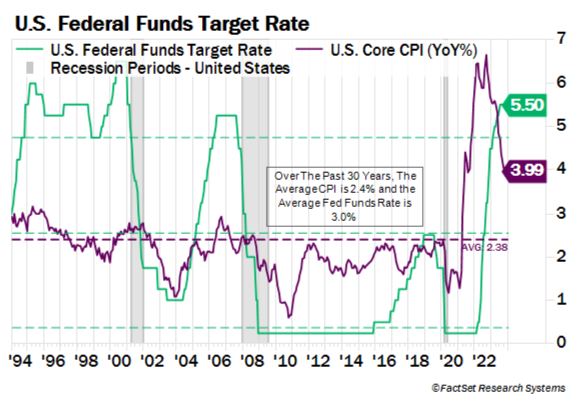

Quantitative Easing, Tapering, Liftoff, and Rolloff

What Does It All Mean? The primary monetary policy tool for central banks is setting the level of short-term interest rates. For the U.S. Federal Reserve (Fed), this means adjusting […]