The first quarter started off with a bang…a new president with new policies and a raise in the interest rates with promises of more to come. On top of that we had the continuation of the “Trump rally” which has pulled the stock market up 14% since the election. Driving the market was talk of a tax cut and increasing spending on infrastructure. Whether this will actually happen is a question that will soon be answered. In any case, a volatile but key component to our economy has increased sharply in recent months.

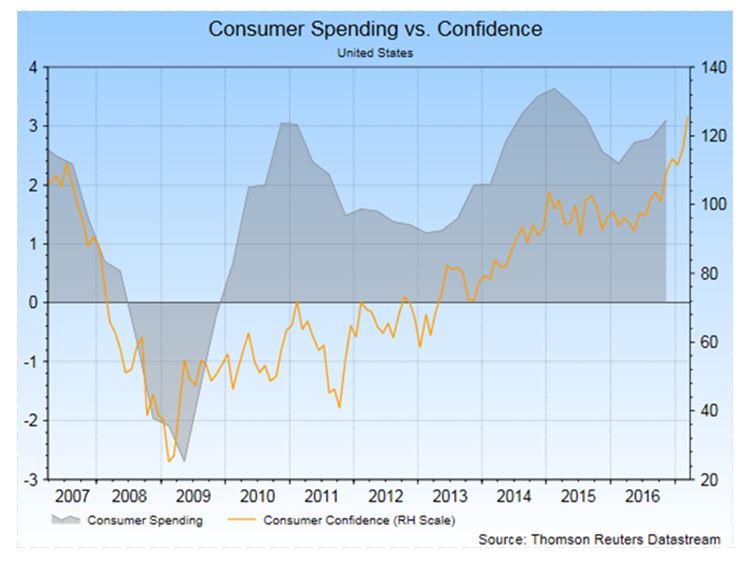

Consumer confidence has been rising in fits and spurts since the bottom in 2009. In March of that year, the Consumer Confidence Index® hit a low of 23. By the end of 2013, it had risen to over 70 and now stands at 125. Over time, confidence has a high correlation to spending. Confidence comes from various sources but is most heavily influenced by the stock market, housing and employment, in that order. There used to be a higher correlation to housing prices than the stock market, but the collapse of the housing market is still fresh in everyone’s mind.

While confidence has doubled in the last five years, spending has lagged behind, stuck at around 3% growth, barely above inflation. Some of the issue has to do with demographics. Baby boomers own more stocks than other age groups and as they mature they spend less. The stock market makes them and others happy, but the perceived volatility in the markets restricts the confidence required to spend.

Housing on the other hand is less volatile and retains a high relationship with spending. The problem this time is that although home prices have been rising, the inventory has not been growing. Builders and lenders are cautious. Lenders also have a host of new rules and regulations to wade through that slow the process. Buyers are not looking at homes as investments as much as they have in the past. The debacle of 2008 changed attitudes towards homes as piggy banks for the foreseeable future. However, as home prices climb and millennials discover the joy of home ownership, the pressure will be on to increase the housing stock.

The current economic situation is quite positive and is still improving. Wage growth, employment, home prices and inflation are all on the right track. As the new administration determines and implements policies, we assume some of the uncertainty will be cleared up. We believe the “wealth effect” is still a factor in consumer spending, but you need housing as well as stocks to be on the same path. This has been true in terms of prices but not the number of units. The number of home sales in the U.S. is critical to growth and spending. The tipping point for this will be an increase in housing inventory with easier access to funds. This could happen sooner than we expect.