Why are markets so volatile even though the Federal Reserve telegraphed their interest rate stance? Under the leadership of Chairman Jerome Powell, today’s Federal Reserve Board was supposed to be […]

The Resiliency of Markets and Mankind

It’s December 31st, 2019 and financial markets around the world just capped off one of the best years on record. At that time, if someone had told you we were […]

The Rotation from Growth to Value

The financial media has recently begun to focus on the ongoing rotation from U.S. growth stocks to U.S. value stocks. Specifically, a rotation out of high valuation, momentum growth companies. […]

FOMO – Battling Biases in 2020 and Beyond

As 2020 begins, the year may change, but human nature does not. Humans evolve and refine their thinking, yet common cognitive biases remain. This is especially true when markets are […]

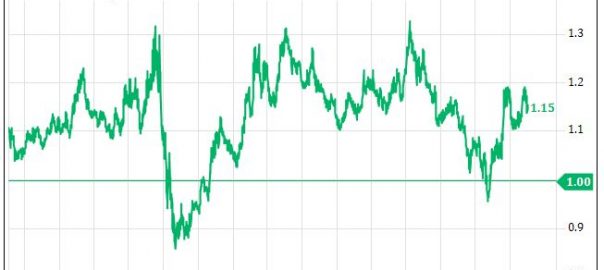

The Bull Stock Market in the Bear Economy

Signs of economic weakness are pervasive. Quantitative evidence from economic reports is depicting an obvious economic slowdown. Additionally, qualitative evidence, such as “expert” commentary and recession related media headlines, means […]

What Does the Recent US Stock Market Action Mean for 2019?

The old saying “stock prices follow earnings” was not in effect during 2018. The S&P 500 delivered outstanding earnings growth of 22% during the year. However, this impressive earnings growth […]