Justin McNichols, CFA

Chief Investment Officer, Principal |

Justin is the Chief Investment Officer for Osborne Partners, and has over 25 years of experience. Justin is a member of the Osborne Partners Investment Management Team, and became a principal of the firm in 2000. Previously, he was with Wells Fargo Asset Management. At Wells, Mr. McNichols was head of equity research, and a member of the national growth equity team. Additionally, he managed over $1 billion in separate account and mutual fund assets. Justin is a member of CFA Society San Francisco and CFA Institute. Justin received a Bachelor of Arts degree in Economics in three years and a M.B.A. in Finance from the University of California at Irvine. Additionally, he is a CFA Charterholder.

Publications by Justin McNichols, CFA

November 13, 2020 | Global Equities

The Rotation from Growth to Value

October 16, 2020 | Economics

Managing Portfolios During the Most Unique Election of Our Time

July 17, 2020 | Investment Commentary

Is Osborne Partners a Growth or Value Manager? Yes.

April 14, 2020 | Economics

The Sentiment Virus

January 15, 2020 | Economics

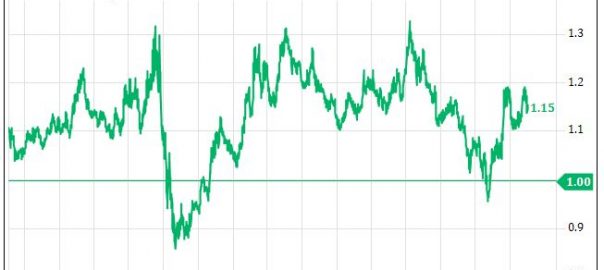

The Great Normalization

October 20, 2019 | Global Equities

The Bull Stock Market in the Bear Economy

July 14, 2019 | Global Equities

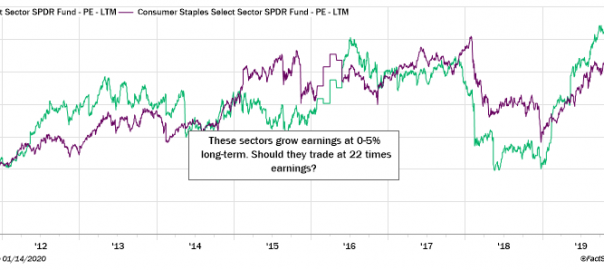

Safe Is Not Safe Anymore

April 14, 2019 | Economics

Do the Recent Yield Curve Inversions Guarantee a Recession?

January 23, 2019 | Global Equities

What Does the Recent US Stock Market Action Mean for 2019?

October 19, 2018 | Global Equities