After many decades of absolute and relative returns, it became clear why multi-asset class investing was a preferred investing discipline for both large institutions and individuals. Institutional investors would list reasons for their multi-asset class discipline preference such as asset class diversity, equity-like returns with lower standard deviation, low downside capture, and a positive U.S. dollar versus interest rate correlation. Meanwhile many individuals would simply say, “I like this discipline because my portfolio does well during easy years, and I don’t get crushed during market corrections.” Both sets of investors are correct.

Multi-asset class investing does offer investors asset class diversity, returns with lower risk, and a discipline that enables a portfolio to fall less in value during market corrections. Today however, one of the most important characteristics of multi-asset class investing, the dollar and interest rates correlation, is causing a more difficult environment for this and most other investing styles. What do we mean?

For many decades, the dollar and interest rates have been highly positively correlated (0.70 is our calculation). This simply means they generally move in the same direction. The idea makes sense because usually when interest rates are rising, the economy is strong (versus other countries), and the dollar is strong (versus other currencies). The inverse is true as well. The relationship between the dollar and interest rates affects multi-asset class portfolios because the direction of each acts as headwinds or tailwinds to each asset class. Let’s review the possible dollar and interest rate scenarios.

There are only four possible scenarios for the dollar and interest rates. The four are: 1) both up, 2) both down, 3) the dollar up and interest rates down, and finally 4) the dollar down and interest rates up. Three of these four are more common. The dollar and interest rates generally rise and fall together, while sometimes the dollar will peak and begin to fall later in an economic expansion while interest rates are rising. In fact, these three have occurred about 85% of the time over the last 50 years. The fourth scenario, where the dollar rises and interest rates fall is fairly rare for obvious reasons. If interest rates are falling, the economy is usually slowing, and the dollar should slow as well.

But what happens if there is a global effort to manipulate one of the two lower? And what if there is a global effort to manipulate one of the two to zero or even negative? When this occurs, the correlations temporarily decouple, the 4th scenario arises, and investors act dangerously irrational. This is the environment we see today. In mid-2014, the European Central Bank (ECB) reduced their benchmark deposit rate to -0.1%. The goal was to reduce borrowing costs for individuals and companies, while punishing banks for holding cash versus lending. The plan would spur loan growth, thus increasing economic activity and increasing inflation as well. Unfortunately, after fearing a strong currency which would hurt exports and their economies, Denmark, Sweden, Switzerland, Japan, and other countries followed the ECB. These actions soon caused the dollar to strengthen because our economy was stronger, while U.S. interest rates crept lower because rates outside the U.S. were at record lows. The unprecedented actions of global central banks to manipulate interest rates to zero or negative levels, has caused the scenario of “dollar up, interest rates down” to occur. So what is the effect for a multi-asset class portfolio?

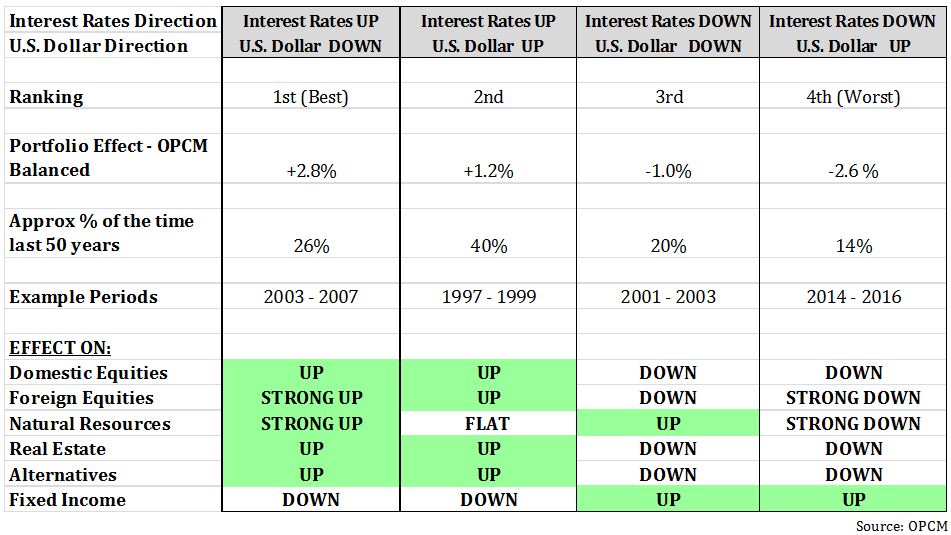

In the table below, we show the four different dollar and interest rate combinations in four columns. In each column, we list the combination’s performance ranking, portfolio effect, approximate percent of the time the combination has occurred during the last 50 years, along with example time periods for each. In the lower portion, we show the effect of each asset class by the combination.

The key figure in this table is the “portfolio effect.” The portfolio effect shows the combination’s performance effect on an OPCM multi-asset class portfolio, before any performance of the actual portfolio holdings. View it as a head start (positive or negative) before returns are even considered. In the scenario of interest rates down and the dollar up, the portfolio should experience a negative 2.6% return headwind. This headwind is quite a difference to the first two scenarios, which together occur 65% of the time. The portfolio effect return difference can be over 5% if you compare interest rates up and dollar down (+2.8%) to the inverse (-2.6%).

The reaction of the different asset classes makes sense. In a strong dollar environment, the U.S. is usually experiencing stronger economic growth versus the globe, so foreign equities, natural resources, and many alternatives should underperform. The interest rate effect is even more amplified today because rates are being manipulated toward zero. The amplification is causing investors to act both irrationally and dangerously in two major ways. First, investors are using equity sectors as bond proxies by chasing their dividend yield. Practically any stock in the utilities, consumer staples, and telecom sectors with a yield over 1.5% is being chased by investors. These same investors are forgetting these are not bonds, but in most cases lower quality, risk laden stocks.

As a trio that comprises 16% of the S&P 500, these three sectors represent 100% of the S&P 500’s performance in 2016. This means the other 84% of the S&P 500 has a return of 0% in 2016. What are the characteristics of these three sectors?

- 5% long-term earnings growth – well below the overall S&P 500.

- 3% estimated earnings growth in 2016.

- A P/E ratio of 20x for utilities, 23x for staples, and 25x for telecom. All more than 50% above historic medians.

- Debt to capital levels of over 50%.

There is no doubt these three sectors are in bubble territory. When they normalize, investors could lose half of their investments or more. The second way investors are acting irrationally is by buying bonds with long maturities, while caring less about quality every day. This maturity leaping and junk chasing is unlikely to end well.

So what does this unprecedented environment mean for multi-asset class investing?

- First, some characteristics will not change. The discipline will always provide needed portfolio diversity. More importantly, it will reduce risk and protect portfolios during corrections. During the steep correction earlier in the year, it was typical to see our multi-asset portfolios down half as much as markets.

- Next, with manipulated, record low interest rates, redeploying fixed income proceeds from maturing bonds will be more difficult, and our team may take longer to reinvest capital.

- Additionally, if the dollar continues to strengthen, it will be a headwind to foreign equities and natural resources. However, fundamental inflection points along with exceptional valuation are starting to overtake the strong dollar headwind. As an example, our natural resources asset class is up over 25% in 2016 at the time of this writing, while emerging markets are posting solid returns this year.

- Finally, if the irrational buying of bond proxies at bubble valuations continues, the headwind in the domestic equities asset class will continue. Our methodical discipline does not allow the investment team to purchase companies with high debt and no earnings growth, trading at 25 times earnings. However, we believe follow-on effects from Brexit across Europe, questions about global monetary policy, upcoming election uncertainty in the U.S., and overall market volatility, will provide ample opportunity to add fundamentally strong companies at exceptional values to the portfolio.

Markets eventually normalize, and historic correlations between economic indicators will return. In the meantime, our multi-asset class discipline will provide diversity and defend against upcoming volatility and corrections. At the same time, our discipline will stay consistent, and we will not chase these future ticking time bombs in order to increase the portfolio’s income by a few dollars.