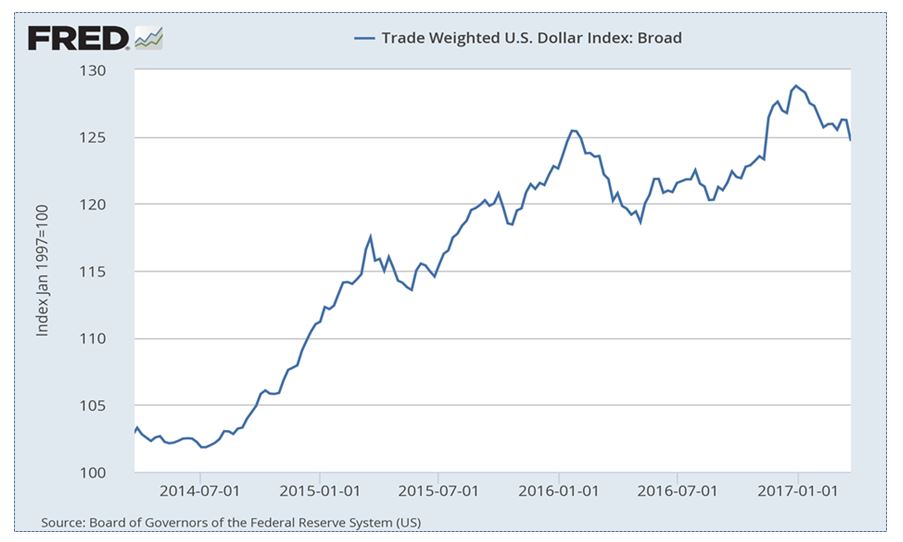

Over the past few years, the U.S. dollar has marched higher driven by several factors including a recovering U.S. economy, expectations for tighter monetary policy, and sluggish growth prospects outside of the U.S. These were among the reasons we initially added our long U.S. dollar position, in addition to our belief that having exposure to the dollar would accomplish one other objective: to hedge the currency risk in our portfolio. But after several years of steady performance and many people starting to express doubt that the dollar rally can continue much longer – does it still make sense to own the greenback? In this piece, we will take a look at this question, and explain how we view the role of the U.S. dollar in a diversified portfolio.

Our position in the dollar is one of several that make up our alternatives asset class. In general, the primary role of this asset class is to hedge against a variety of risks including interest rate risk or currency risk. As mentioned above, our position in the dollar helps to hedge the currency risk in your portfolios. For those wondering what currency risk is – it can be broadly defined as losses brought on by adverse movements in one or more currencies. As an example, if you live in the U.S. and purchase a one-year bond issued by Mexico paying 2% and the peso subsequently falls by 5%, you will lose money when your funds are converted back to U.S. dollars. Currency movements affect each and every asset class, but have historically had a more profound impact on international assets and natural resources.

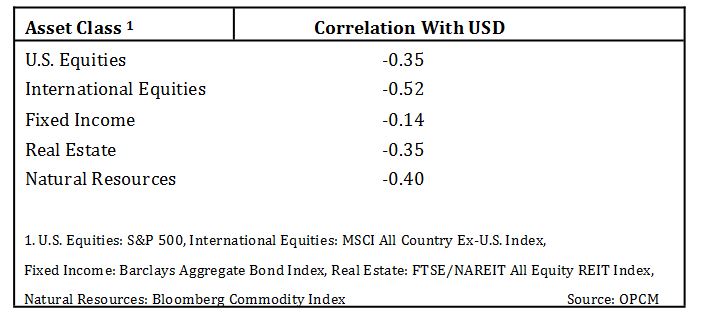

To help demonstrate how U.S. dollar exposure acts as a hedge to other parts of your portfolio, consider the table below which shows the correlations between the dollar and other asset classes over the past 20 years. Correlations span from -1.0 to +1.0 with -1.0 meaning two assets move completely opposite of one another and +1.0 meaning they move in complete unison.

As you can see from the table, the dollar has had a negative relationship with every major asset class over the past two decades. Over shorter time frames like the past 3-5 years, these correlations may not always hold, however periods like these have proven to be anomalous over the course of time. The negative correlation that the dollar has displayed is the hallmark of diversification and should reduce the overall volatility and risk in your portfolio. We saw this benefit first hand when international equities sold off by over 20% from summer 2014 until early January 2016 – a period in which the dollar was up over 20%. Additionally, the efficacy of the dollar as a hedge has notably increased during periods of significant volatility in equity markets, like the last two U.S. recessions in 2001 and 2008-2009, exactly when you need diversification the most.

Over the past three years the dollar has rallied over 20%. Our investment team is skeptical that the dollar can replicate the rally seen in recent years for reasons including the maturity of the U.S. economic recovery, foreign economies closing the growth gap vs. the U.S. and other prominent central banks taking initial steps to shift away from ultra-accommodative (and typically currency damaging) monetary policies. Despite this outlook, we value our position in the dollar as a currency hedge and believe it will continue to effectively lower the overall risk in your portfolio.